Are Employee Business Expenses Deductible In 2024 California – The Private Attorneys General Act, or PAGA, allowing employees to file suits was unlawfully denied reimbursement for expenses, is pending in the California Supreme Court. . If you’re one of the growing number of independent contractors, retirement planning can sometimes seem daunting given the lack of access to a traditional retirement account like a 401 (k). Fortunately .

Are Employee Business Expenses Deductible In 2024 California

Source : taxfoundation.orgCalifornia Employers Face Increased Paid Sick Leave Requirements

Source : www.californiaemploymentlawreport.comCardata

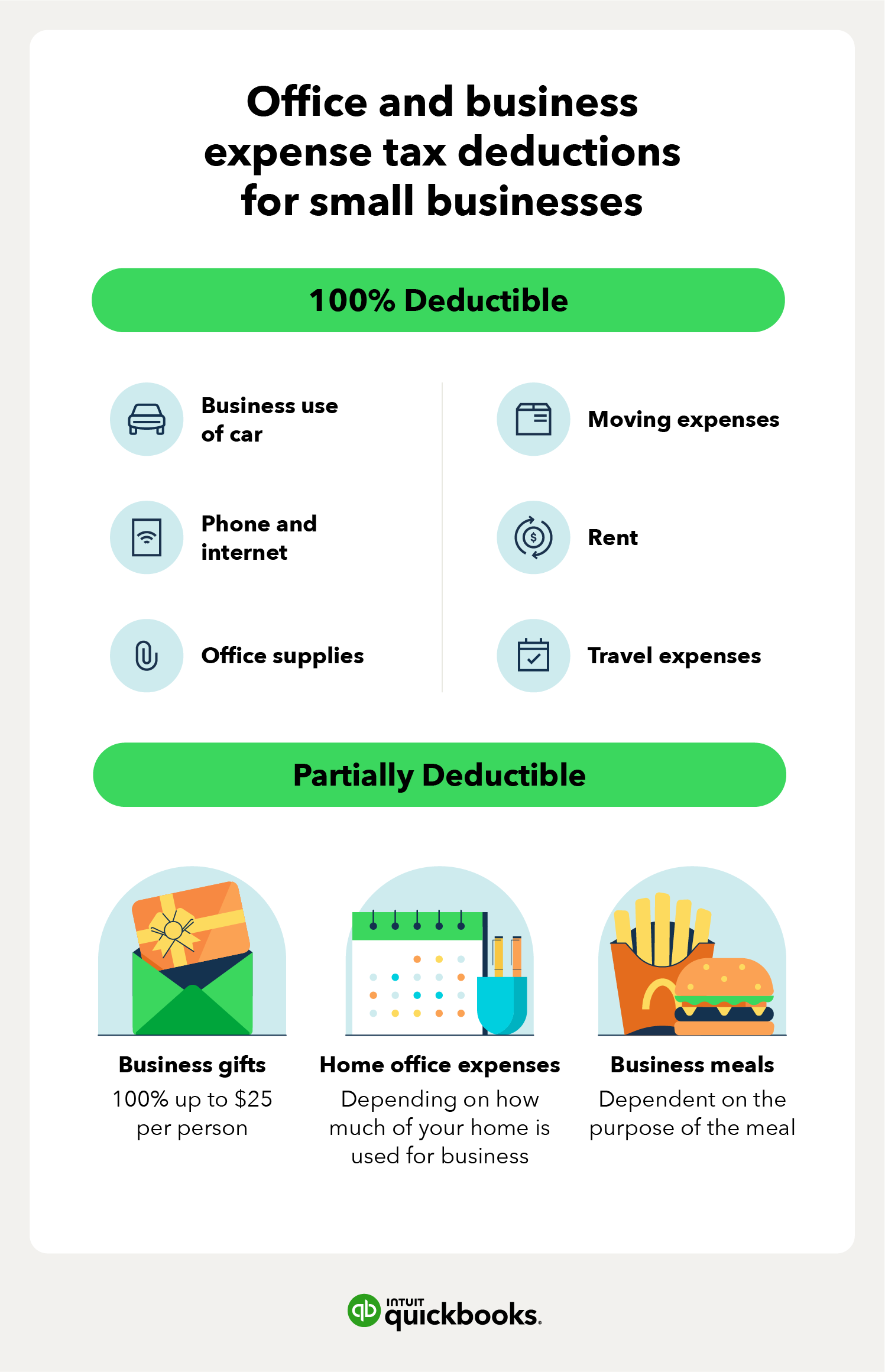

Source : www.facebook.comSmall Business Expenses & Tax Deductions (2023) | QuickBooks

Source : quickbooks.intuit.comCalifornia SDI Payroll Tax Cap Eliminated in 2024

Source : www.newfront.com2024 State Business Tax Climate Index | Tax Foundation

Source : taxfoundation.orgSmall Business Expenses & Tax Deductions (2023) | QuickBooks

Source : quickbooks.intuit.comLow and Alameda County Social Services Agency | Facebook

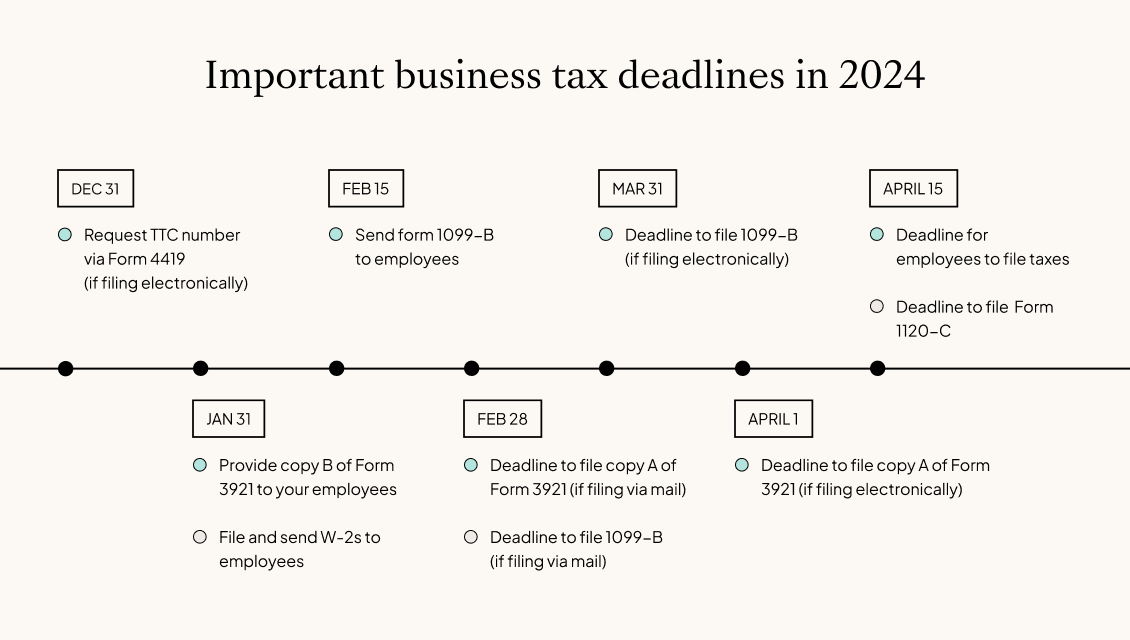

Source : m.facebook.comBusiness tax deadlines 2024: Corporations and LLCs | Carta

Source : carta.comHow To Start A Business In California (2024 Guide) – Forbes Advisor

Source : www.forbes.comAre Employee Business Expenses Deductible In 2024 California 2024 State Business Tax Climate Index | Tax Foundation: Assuming there’s no policy against it, reaching out individually to your co-workers is wise. It’s essential to gauge their interest and comfort levels with the idea of dating someone from the same . No matter how many vehicles your business owns, you need commercial auto insurance. Find out what this type of business insurance covers and why you need it. .

]]>