Business Miles Deduction 2024 Calculator – Not only will this make paying employees and vendors easier but it will also help you maximize deductions come we could then calculate which business expense tracker came out on top. . T axpayers who claim the standard mileage rate deduction for the miles they log for business purposes will be able to write off 67 cents per mile in 2024, the IRS recently announc .

Business Miles Deduction 2024 Calculator

Source : triplogmileage.comIRS Mileage Rate for 2023 2024 | Moneywise

Source : moneywise.comHawaii Employers Council IRS Issues Standard Mileage Rates for 2024

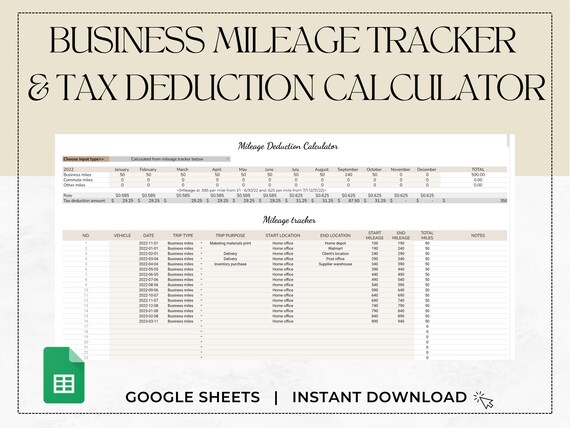

Source : www.hecouncil.orgBuy Business Mileage Tracker & Auto Mileage Expense Deduction

Source : www.etsy.comStandard Business Mileage Rate Increases for 2024 Landmark CPAs

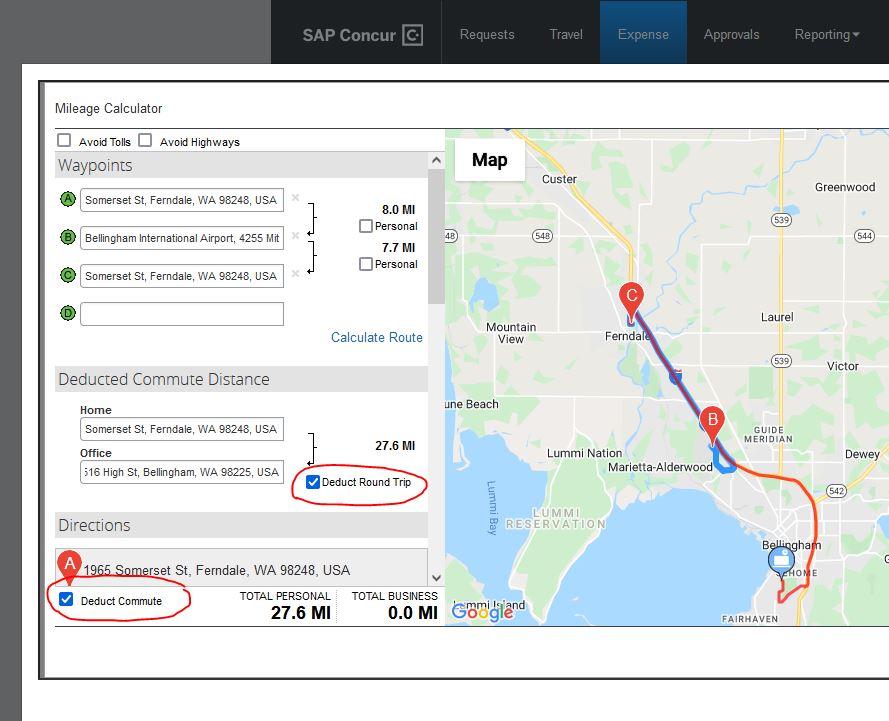

Source : www.landmarkcpas.comMileage & Ground Transportation | Business Services | Western

Source : business-services.wwu.eduFree IRS Mileage Calculator Calculate Your 2023 Business Mileage

Source : www.driversnote.comThe Standard Business Mileage Rate Will Be Going Up Slightly in 2024

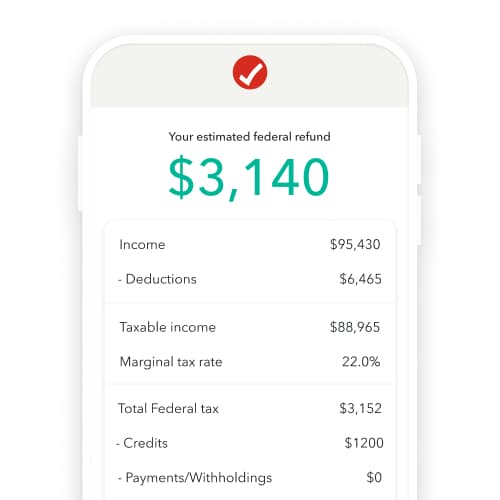

Source : gordonkeeter.comFree Tax Calculators & Money Saving Tools 2023 2024 | TurboTax

Source : turbotax.intuit.comAccounting of the Palm Beaches | West Palm Beach FL | Facebook

Source : www.facebook.comBusiness Miles Deduction 2024 Calculator Self Employed Worker Mileage Deduction Guide (2024 Update): She has been instrumental in tax product reviews and online tax calculators mileage rates for business-related transportation. If you use your car for business purposes, you can deduct 65.5 . For 2024 the IRS allows you to deduct $0.67 per mile for business use have the option of using the IRS mileage allowance to calculate how much it costs to own and operate a car for tax .

]]>